If the fraud involves multiple customers, notify them as soon as possible to inform them of the situation and to provide guidance on how to protect their personal and financial information. You may have never been to the dark web — but there’s a chance your credit card information has. Learn the basics of credit card cards, including features, fees, and rewards to make informed decisions about your credit card usage. The threat actor behind the AllWorld Cards marketplace has a clear goal in mind. They are actively promoting the platform on Dark Web hacking-related platforms since late May 2021.

What Risks Come With Dark Web Credit Card Fraud?

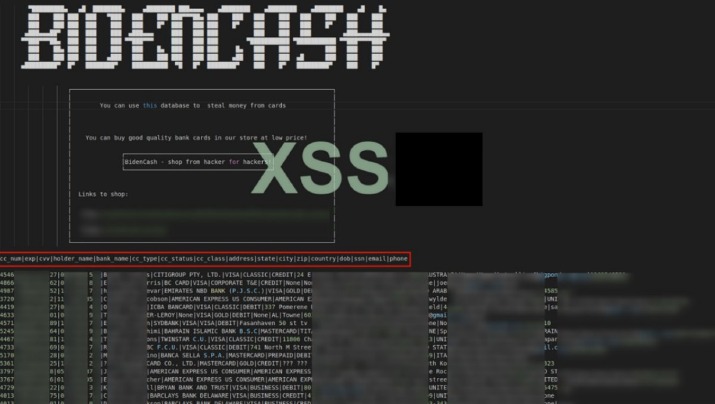

Unlike carding shops, which primarily focus on the trade of information, carding forums serve a broader purpose within the cybercriminal community. On these forums, actors will often share techniques, hacking tools, strategies, and resources for conducting fraudulent activities. In addition to PayPal account balances, they can also transfer money from any connected bank accounts or credit cards. On top of all that, they could make purchases or request money from contacts listed in the PayPal account. When a hacker writes up new malware, steals a database, or phishes someone for their credit card number, the next step is often toward dark net marketplaces. These black markets allow buyers and sellers to make anonymous transactions using a combination of encrypted messages, aliases, and cryptocurrency.

- It has gained a reputation for being a reliable source of high-quality data for cybercriminals.

- Abacus Market quickly rose to prominence by attracting former AlphaBay users and providing a comprehensive platform for a wide range of illicit activities.

- Due to its extensive inventory and reputation for reliability, Brian’s Club has maintained a significant presence on the dark web.

- Some fullz even include photos or scans of identification cards, such as a passport or driver’s license.

- It is a hub for financial cybercrime and offers a wide range of illicit services and stolen data that cater to sophisticated cybercriminals.

Full or partial credit card details, also known on the dark web as CVVs and CCs. These listings can include information such as the BIN number, credit card number, expiration date, and CVV number. Carding has long been a prevalent form of online crime—and it remains a serious threat. One such protection is the use of anti-fraud tools, such as F‑Secure Total, our complete online security solution. These tools offer consumers the most effective way to defend against carding attacks. By monitoring dark web markets, we often discover data breaches before they’re publicly reported.

Category #1: Details Needed For Fraudulent Online Purchases

The dark web is a section of the internet that is not indexed by traditional search engines. It hosts a variety of sites, many of which are involved in illicit transactions, including the buying and selling of credit card information. Due to limited data on credit cards from other countries, we were unable to adequately compare prices for credit cards from different places. To protect yourself from credit card theft and fraud, be careful and be covered. A rogue restaurant employee can copy your card data when you’re not looking (this scam is called shoulder surfing).

Not only is there a way for hackers to discover payment card numbers without breaking into a database, there’s also a booming underground black market for them. The shop offers stolen card data from around the world for as low as $0.15 per item and uses verification and automated checks to check the validity of the cards people put up for sale on the platform. The dark web has become a notorious hub for illegal activities, and credit card fraud is no exception. Criminals exploit the anonymity and encryption features of the dark web to buy and sell stolen credit card information. This underground marketplace offers a range of stolen credit card details, including card numbers, CVV codes, and even full personal information.

Avoid Having Your Credit Card Info Published On The Dark Web

For instance, Resecurity identified several Chinese underground vendors focusing specifically on compromised payment data belonging to Saudi citizens. NFC technology and contactless payments are gaining significant popularity in the MENA region. These countries have seen rapid adoption of NFC-enabled payments, with Saudi Arabia leading the way with 98% contactless payment adoption for in-person transactions. The MENA region is also experiencing a surge in digital payments, including those facilitated by NFC, that’s why financial institutions will be a target of cybercriminal and fraudulent activity.

What Should I Do If My Credit Card Information Is Stolen?

No matter how vigilant you are, there is nothing you can do to prevent a data breach on a merchant’s website, but using a virtual card can shield your actual card data from being exposed. Rather than relying on yourself to create your own strong passwords, consider using a password manager. Password managers aid in creating, managing and storing your passwords so you won’t forget them. Some password managers like Keeper® even come with the ability to store Two-Factor Authentication (2FA) codes so you can add an additional layer of security to your accounts seamlessly. When a card is skimmed, the threat actor obtains all its information including the cardholder name, number, expiration date and Card Verification Code (CVC).

Airport Lounge Access Credit Card: How To Apply

It emulates the Host-Card-Emulation (HCE) process, simulating card-terminal interactions and APDU (Application Protocol Data Unit) exchanges. Cybercriminals exploit the same approach by manipulating HCE for malicious purposes to process compromised credit card data via NFC. Remember, while the dark web might seem like the realm of shadowy figures and digital desperados, the true power lies in the hands of those who choose to fortify their defenses. Your credit card data—and by extension, your financial future—is worth protecting. With the right strategies, even the most sophisticated cyber threats become manageable challenges rather than insurmountable obstacles.

What Are Stolen Credit Cards Used For?

The documents being offered for sale encompass various sensitive information, such as marksheets, signatures, passport-size photos, caste certificates, Aadhar cards, and more. The threat actor mentions that the data is accompanied by a vulnerability report, with a combined price of $5,000. Organizations with greater cyber situational awareness will be able to detect and respond to these instances more quickly. The analysts claim these cards mainly come from web skimmers, which are malicious scripts injected into checkout pages of hacked e-commerce sites that steal submitted credit card and customer information. The “special event” offer was first spotted Friday by Italian security researchers at D3Lab, who monitors carding sites on the dark web. The first step you should take is to contact your bank or credit card issuer immediately.

Web Hosting Company Increases Security Team Bandwidth With Up To 80% Decrease In Threat Research Times

Once your personal information hits the dark web, it’s nearly impossible to remove it. But while you can’t undo a data breach, you can take control of what happens next. From strengthening your digital habits to setting up fraud alerts and monitoring your accounts, small steps can make a big difference. Traditional payments typically require some Cardholder Verification Method (CVM) such as PIN or signature. For low-value contactless payments below the “Contactless CVM limit,” no CVM is required—the consumer can simply Tap & Go. TheZ-NFC behaves like a malware loader, using advanced Android packing,native code injection, and NFC emulation to conceal and executepayloads.

Keep in mind that you still need to reach out to the subscription provider if you’d like to cancel the service. Spyware and malware attacks are another common tactic used by scammers to steal data, and they are typically a result of phishing schemes. Credit card theft has become one of the most common types of fraud, with the U.S. projected to lose a staggering $165 billion in the coming 10 years due to card abuse. Additionally, it’s crucial to stay informed about the dark web’s evolving tactics and trends to mitigate risks effectively.

NFC (Near Field Communication) fraud is a growing concern due to the increasing adoption of NFC technology in mobile payments, identity verification, and other contactless applications. The rise of contactless payments, especially during the COVID-19 pandemic, has significantly increased the volume of NFC transactions. This growth has created more opportunities for fraudsters to exploit the technology. As the market for contactless payments continues to expand, so does the potential for NFC-related fraud. NFC is also used for identity verification, making it a target for identity theft.