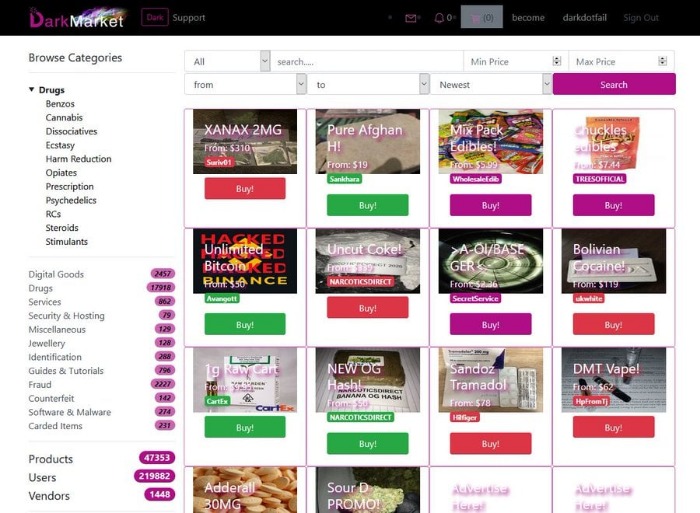

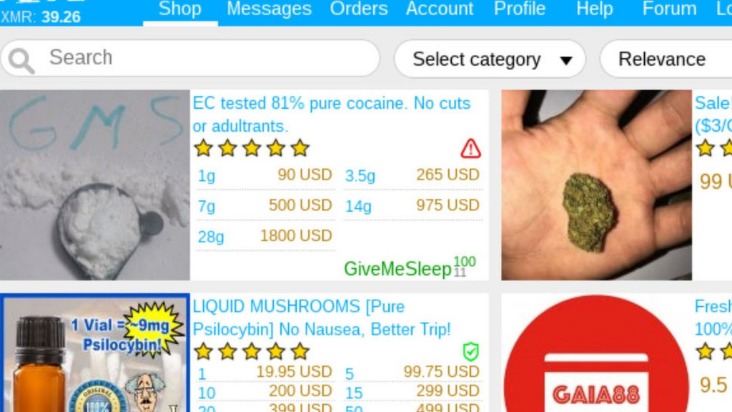

Some marketplaces explicitly ban the trade of fentanyl, while others claim to prohibit it but fail to enforce the rule. Others may allow the sale of precursor chemicals rather than the final product, further complicating law enforcement efforts. Law enforcement agencies continue to focus their efforts on darknet marketplaces, particularly those involved in the trade of illicit substances.

Stop Pretending Bitcoin Self Custody Is Easy, It’s Not

The cryptocurrency space remains vulnerable to scams that exploit investor trust and security weaknesses. Fraudulent ICOs, rug pulls, and phishing attacks deceive users through false promotions and impersonation tactics. These threats highlight the need for stronger security measures, regulatory oversight, and increasing user awareness.

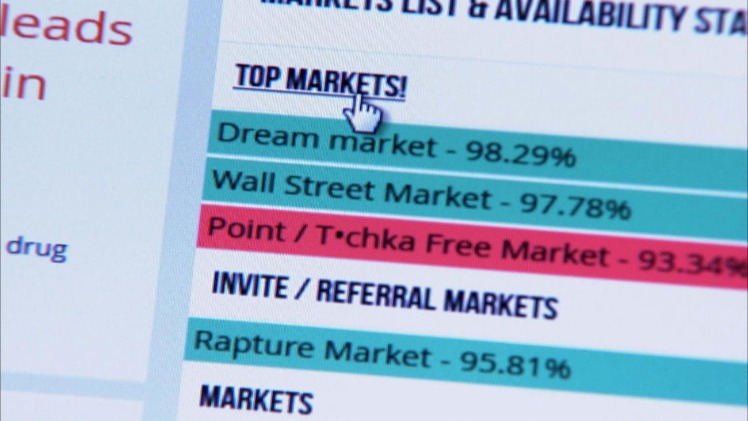

Shuttered Dark Web Marketplaces

While they provide anonymity, they also pose regulatory challenges by complicating financial tracking and raising concerns about illicit activities. In total, law enforcement agencies across the world have shared data collected from the seized website and cryptocurrency exchanges to identify and prosecute its customers. So far, this information has been sent to 38 countries and resulted in the arrest of more than 337 people across the globe. There have been searches of residences and businesses of 92 different individuals in the U.S., two of whom were former federal agents. The Reactor product essentially simplifies how people can see cryptocurrency transactions so that data from those insights can be more easily digested and understood.

Notably, our dataset includes Silk Road (the first modern DWM)1, Alphabay (once the leading DWM)44, and Hydra (currently the largest DWM in Russia)12. Other general statistics about our dataset can be found in the Section S3. Overall, our study provides a first step towards the understanding of how users of DWMs collectively behave outside organised marketplaces. Our research details a thriving underground economy and illicit supply chain enabled by darknet markets. As long as data is routinely stolen, there are likely to be marketplaces for the stolen information.

Insights And Caveats From Mining Local And Global Temporal Motifs In Cryptocurrency Transaction Networks

Putting aside Bitcoin, another crucial break in the case can be found in the indictment (explicit) for WTV’s administrator, Jong Woo Son. In September 2017, investigators discovered that by right-clicking the WTV homepage and selecting “view page source,” anyone could view the website server’s IP address. An obvious observation from a follow-the-money perspective, using one publicly immutable ledger makes it far less difficult and time consuming to analyze transactional data. Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool?

Formation Of U2U Stable Pairs

In the wake of recent headlines announcing actions against Hydra Marketplace by the U.S. and German governments, darknet markets have made an ironic entrance into the spotlight. Copy this text in its entirety and paste it into the ‘Send BTC to address’ tab in Localcryptos (or into your personal bitcoin wallet if that’s what you’re using) and select the amount of bitcoin you wish to send. If you’re using Localcryptos, press the yellow button marked ‘Transfer’ and then sit back and wait. Within minutes, your coins will show up in the BTC wallet for your darknet account.

In retrospect, bitcoin’s focus on being a store of value overlapped with the development of the required privacy for darknet market use. Each coin has its own history, and that history may be accounted for when a user tries to use his coins. That history could also lead to the user getting in trouble when using/holding coins that were used in a criminal manner, for example drug trade or an exchange hack. Excluding privacy currencies from central exchanges doesn’t eliminate their use. Instead, it forces transactions into less regulated markets or peer-to-peer platforms, potentially favoring decentralization and hindering supervision.

Previous studies reported that COVID-19 had a strong impact on DWMs due to delays and damage to the shipping infrastructure caused by border closures37,38. We start by investigating the number of new stable U2U pairs and their trading volume during the COVID-19 period. Users in stable pairs meeting both inside and outside DWMs have been growing over the last two years, since the shutdown of AlphaBay9, the largest DWM at the time. In 2020, a total of 6778 pairs of users in stable pairs met inside a DWM, corresponding to 192% of the 2019 level and to 255% of the 2018 level, see Fig. Pairs of users in stable pairs meeting inside a DWM traded for a total of $145 million in 2020, which corresponds to 252% of the 2019 level, and to 593% of the 2018 level, see Fig. The impact of the COVID-19 pandemic has, however, had different phases, punctuated by the number and level of measures introduced around the world.

The Dark Side Of Cryptocurrency: How Digital Assets Fuel Money Laundering And Illicit Trades

When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

Access This Chapter

The recent exclusion of Monero by large exchanges has promoted a return to Bitcoin in Darknet markets, demonstrating how regulations directly impact privacy cryptocurrencies. Despite restrictions, the demand for anonymity and privacy persists, and developer communities continue to seek innovative solutions to maintain these values. Despite current difficulties, projects like Monero remain active due to committed communities and continuous technical growth aimed at improving privacy and security. Privacy cryptocurrencies are not only for illicit purposes but also represent a paradigm for protecting financial privacy in an increasingly monitored world.

Table Of Contents

- We estimate that the trading volume of U2U pairs meeting on DWMs is increasing, reaching a peak in 2020 (during the COVID-19 pandemic).

- (c) Total monthly trading volume sent to all DWMs and exchanged in all unique U2U pairs.

- Each time, the owner of this bitcoin address transferred funds to another address held on a “BTC exchange.” The signature card for the account was held in Son’s name.

- The reasons for the differential impact of COVID-19 on U2U trading vs. DWM trading are difficult to pin down.

- In particular, our dataset does not include any attributes related to either users or their Bitcoin transactions, such as, whether the transaction represents an actual purchase or not.

- However, trading behaviour in DWM closely resembles what is observed on regulated online platforms despite their significant differences in operational and legal nature14.

World Market is another largest dark web shops that deals with various goods and services. Its impressive anti-DDoS protection feature and easy-to-use interface make this marketplace stand out among the others. However, the website has some security risks, and users experience glitches. The marketplace has a pleasant, user-friendly interface built from the ground up.

Moreover, data scraped from the DWMs cannot assess the U2U transactions which account for the largest fraction of the total trading volume of the ecosystem13. Dark web news site and guide DarknetlLive lists over 30 active digital black markets that utilize the anonymizing Tor browser and bitcoin to allow users to buy and sell drugs and other illegal products anonymously online. The analysis can also reveal additional addresses controlled by the same individual or entity. IRS-CI’s analysis determined Bitcoin Fog received approximately 486,861.69 BTC, valued at about $54,897,316 at the time of the transactions, directly from darknet markets. Bitcoin Fog sent approximately 164,931.13 BTC (about $23,690,956 at the time of the transactions) directly to darknet markets.

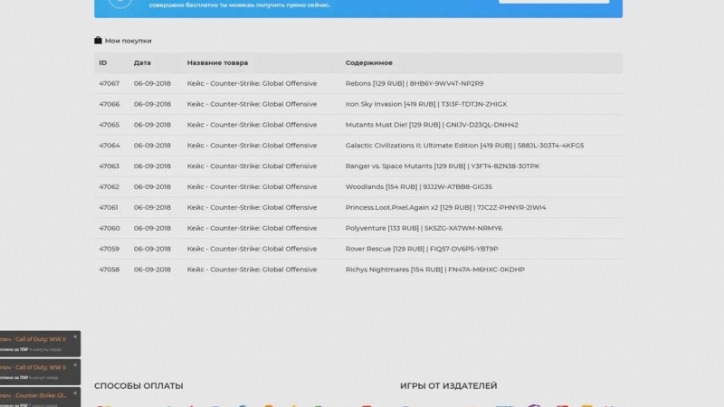

Some dark web marketplaces even host content that’s not just illegal but extremely harmful, so it’s really important to understand the risks before diving in. “Typically, illicit transactions constitute at or below 1% of total crypto activities. While addressing these issues is essential, broadly labeling crypto negatively is inaccurate and counterproductive.” Jardine emphasized that illicit cryptocurrency transactions represent only a minor share of total crypto activity. Next, we extracted information about stolen data products from the markets on a weekly basis for eight months, from September 1, 2020, through April 30, 2021. We then used this information to determine the number of vendors selling stolen data products, the number of stolen data products advertised, the number of products sold, and the amount of revenue generated.

Torzon offers a premium account option for additional benefits and is valued at approximately $15 million, accepting payments in Bitcoin (BTC) and Monero (XMR). WeTheNorth is a Canadian market established in 2021 that also serves international users. It offers counterfeit documents, financial fraud tools, hacking and malware services. It has an active forum and community along with an extensive user vetting process. Chainalysis data shows that about 0.14% of all transactions in crypto, some $50 billion, involve illicit activity, with a rise in stablecoins as an illicit payment mechanism. Silk Road, which emerged in 2011, combined TOR and bitcoin to become the first known darknet market.